A common question from California Veterans when applying for a VA loan is “What is the VA Funding Fee?” The VA mortgage program has many benefits, including no down payment and no monthly mortgage insurance. There is one unique cost however, that is known as the VA Funding fee. The funds from this fee go directly to the VA to help cover potential losses on mortgages that default. The VA Funding Fee is based on a percentage of the loan amount that is dictated by the type of military service that the Veteran performed. Other factors that play a role in the size of your Funding Fee include whether you are paying a down payment or are a first time VA borrower. When it comes to paying the VA Funding Fee, the borrower has the option to either include the VA Funding Fee as part of the loan amount or to pay it in cash upon loan closing.

Example of First Time Use VA Funding Fee

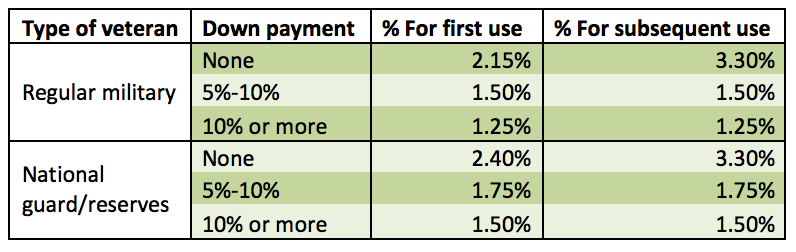

In most cases the Veteran will choose to finance the VA funding Fee into the loan. For example, using the chart below, let’s assume a Regular Military Veteran is purchasing a $400,000 California home with $0 down payment and will be using the VA Home Loan benefit for the first time. The VA Funding Fee will be 2.15%. To calculate the VA Funding Fee, we multiply $400,000 x 2.15% to get $8,600. If the Veteran chooses to finance the Funding Fee, then the total VA loan will be $408,600. **(In 28 years of closing VA loans I do not remember a case where a Veteran chose to pay the VA Funding Fee out of pocket. But it’s possible.) **

Example of Subsequent Use VA Funding Fee

If a California Veteran uses VA financing at a later time, whether to purchase a different home or to do a VA cashout refinance, he would then be subject to a 3.3% VA Funding Fee if the down payment is less than 5%. Assuming the same $400,000 purchase price, but this time for a Veteran who had used VA financing previously, the VA Funding Fee would be $13,200 and the total VA loan would be $413,200. If the Veteran had the ability to put even just 5% down to make the base loan $380,000, the VA Funding Fee would only be 1.5% $5,700. So a “move up” buyer could save on the VA Funding Fee by putting at least 5% down.

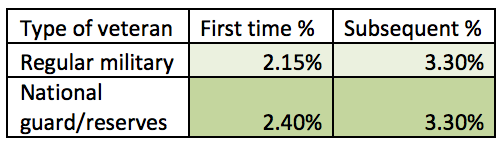

It’s important to note that when refinancing to pull cash out, the VA Funding Fee will either be 2.15% for First Time Use(2.4% for National Guard or Reserves), or 3.3% for subsequent use. The loan to value of the refinance will not help or hurt the Funding Fee calculation.

This chart below lays out what the funding fee will amount to on a VA purchase loan:

This following chart shows you the funding fee percentage for VA cash-out refinances:

Can the VA Funding Fee be Waived?

For those Veterans with a service connected disability and disability rating issued by VA, the Funding Fee will be waived. Whether the rating is 10% or 100%, the Funding Fee will be $0. The VA Certificate of Eligibility will verify for the lender whether a Funding Fee will be required.

VA Funding Fee on an IRRRL

The VA Interest Rate Reduction Refinance Loan, or IRRRL, is a great way for a current VA borrower to take advantage of lower interest rates. There is no income documentation and no appraisal. It is a “VA streamlined refinance“. And to make it even better, the VA Funding Fee on an IRRRL is only .5%.

Authored by Tim Storm, an Orange County VA Loan Officer specializing in VA Loan. MLO 223456. – Please contact my office at the Home Point Financial. My direct line is 949-640-3102. www.CaliforniaVALoanExpert.com. I will prepare custom VA loan scenarios which will be matched up to your financial goals, both long and short term. I also prepare a Video Explanation of the your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process.