The Debt-to-Income ratio is an important factor used when qualifying for a VA loan in California. But what is the Debt-To-Income ratio and how is it calculated?

The Debt-To-Income ratio, or DTI, is one of the factors lenders use to determine whether a borrower can afford their total payments, including the new housing payment, when purchasing a home. VA is fairly flexible with the DTI compared to other types of financing. VA’s guidelines show 41% as the preferred DTI. But it is not uncommon for a VA loan to be approved with a DTI above 50%. Even 60% is not unheard of for a VA loan. It just depends on other factors, including a borrowers FICO score, reserves in the bank, and Residual Income.

Debt: Monthly Debt Payments

In the case of the DTI, Debt should really be thought of as the debt “payment”. Debt-To-Income sounds like a comparison of a Veterans (since we’re talking about VA loans) total debts compared to their income. But it really is the monthly debt payments divided by the gross (before taxes) income. For example, if a Veteran owes $30,000 on a car loan with a monthly payment of $500, it is the $500 that is used in the calculation. Not the $30,000. The DTI will be calculated the same way whether the Veteran owes $30,000 or $10,000. Student loans are probably a better example. A Veteran may have $200,000 in student loan debt, but if the monthly payment is only $300 because they’re on an Income Based Repayment plan, then the fact that they have so much debt won’t hurt them when qualifying for a VA loan.

Income: Total Gross Income before taxes

The income portion of the DTI is fairly straight forward. This is your gross monthly income. “Gross” meaning your income before taxes are taken out. If your annual salary is $120,000, then your gross monthly income is $10,000. If you also receive VA Disability income of $1,000 per month then your gross monthly income is $11,000. VA does allow for disability income to be “grossed up” by 25% since it is not taxed, but for now we’ll leave that calculation alone. For self employed borrowers the Gross Income is calculated AFTER business expenses/writeoffs but before taxes. For example, a self employed person who “grosses” $300,000 but has $250,000 in expenses with an approximate taxable income of $50,000, has $50,000 of income for VA home loan qualifying purposes. Every situation is different, so make sure you have a VA Loan Officer who has experience with income calculation.

The Debt to Income Calculation

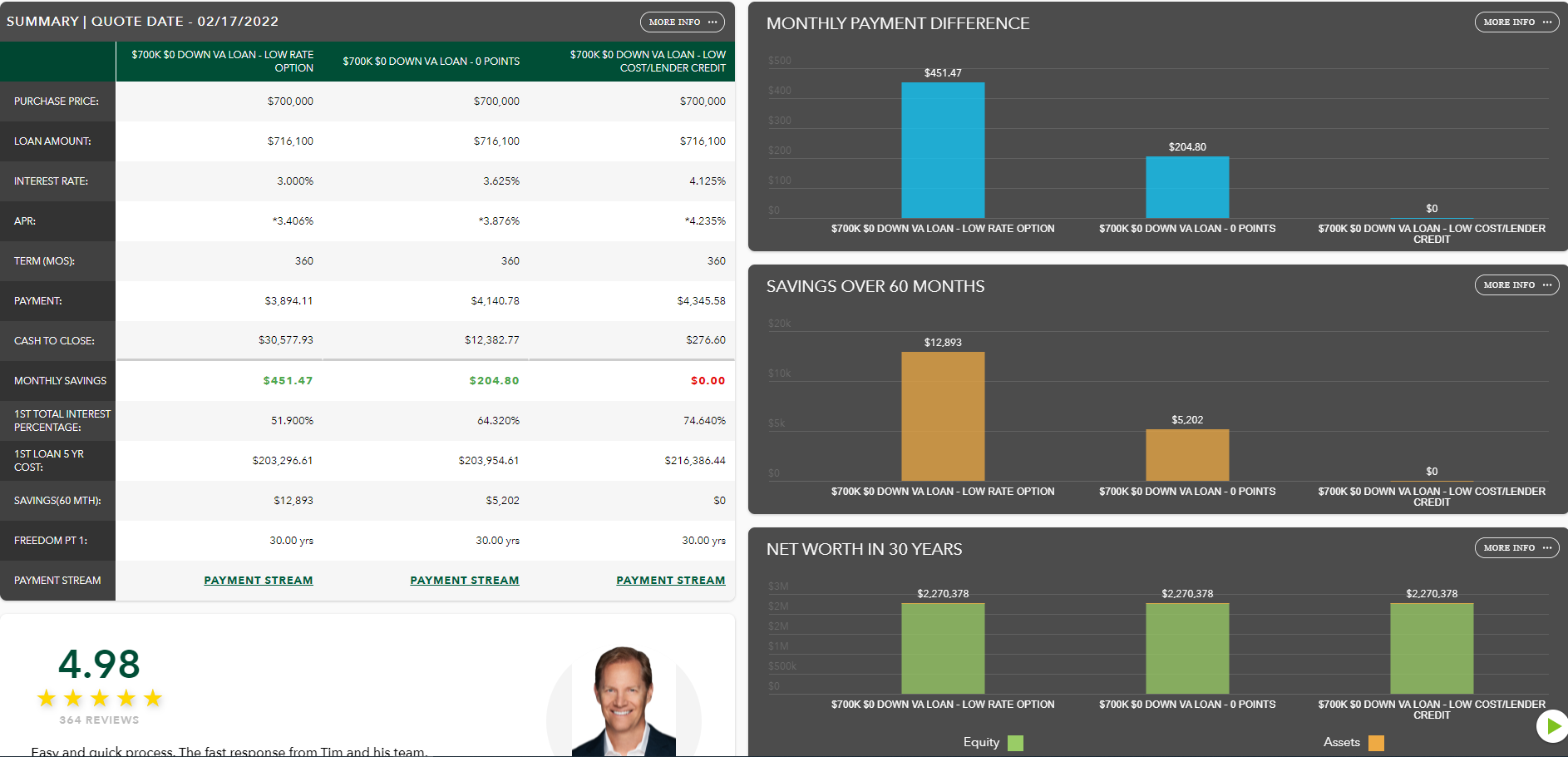

Now that we have the two main components of the DTI, lets do the calculation. Just divide the monthly payments by the gross monthly income. Let’s start out with an example where a California Veteran buys a single family detached home for $700,000 with $0 down payment. Below is a breakdown of the payment assuming a Note rate of 3.625% and APR of 3.876%. We are assuming this to be the “first time use” for the Veteran, meaning a 2.3% VA Funding Fee brings the full loan amount to $716,100. The full PITI payment is $4,150, which is made up of the Principal & Interest ($3,275), Taxes ($729), and Insurance ($146).

Now lets assume our California Veteran has a car payment of $400 and student loan payment of $120. This means that his total monthly obligations, including the PITI, will be $4,670. If the Veteran’s monthly income is $10,000, then the Debt to Income ratio is 46.70%. ($4,670 / $10,000 = 46.7%). In most cases, and as long as the Residual Income calculation is within guidelines, a 46.7% Debt to Income ratio on a VA loan will be lower enough for the Veteran to qualify to purchase the home. There are other factors that will need to be considered as well. For example, the credit and FICO score are very important. And of course, does this payment fit within the Veterans budget based on other potential expenses that the VA lender doesn’t look at (going out for dinners on a regular basis, or vacation spending, tuition, etc). To have a solid idea of what payment will work and what will not, it’s important to work with a California VA Loan Specialist. Below is a link to a complete breakdown of the numbers for buying a $700,000 home. When you click on the image you will also be able to watch a short video explanation of the VA Purchase Analysis.

The First Step in Buying a California Home with a VA Loan: PreApproval

The first step in buying a California home with a VA loan is to talk to a California VA Loan specialist. And we I say “California”, I mean if you are planning to buy in California then make sure you are working with someone who also lives in California. If you are trying to get VA questions answered for a California home purchase from a VA lender in Missouri, good luck. California is unique. Our home prices tend to be higher than other states. Also, we have more condos, and to get a VA loan on a condo you need to find a VA approved condo project. That is not easy and an out of state lender will offer little help in determining which condo projects are VA approved. By working with a California VA Loan specialist, you will have the best chance at finding a qualified VA approved home and closing escrow with as little stress as possible.

Authored by Tim Storm, a California VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Arbor Financial Group NMLS 236669. My direct line is 714-478-3049. I will prepare custom VA loan scenarios that will be matched up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you are able to fully understand the numbers BEFORE you have started the loan process