Buying a home in California with a VA loan is far easier now than before 2024. Looking back to the early 90’s, retrieving a VA Certificate of Eligibility took weeks. Everything about VA financing was very “manual”. Now, in 2024, everything is Automated. Or I should probably say that 90% of the loan process is Automated. Still, to make the process as smooth as possible it’s important to work with someone with experience with VA financing. And in California, it’s important to work with a California VA Loan Officer. California is a unique state. Home values are higher than in most states. And importantly, property taxes are dealt with in California differently than in any other state. Working with a California VA Loan Officer who can understand the nuances of California real estate will give California Veterans an advantage.

California VA Loan Officer will Guide You Through the Home Buying Process

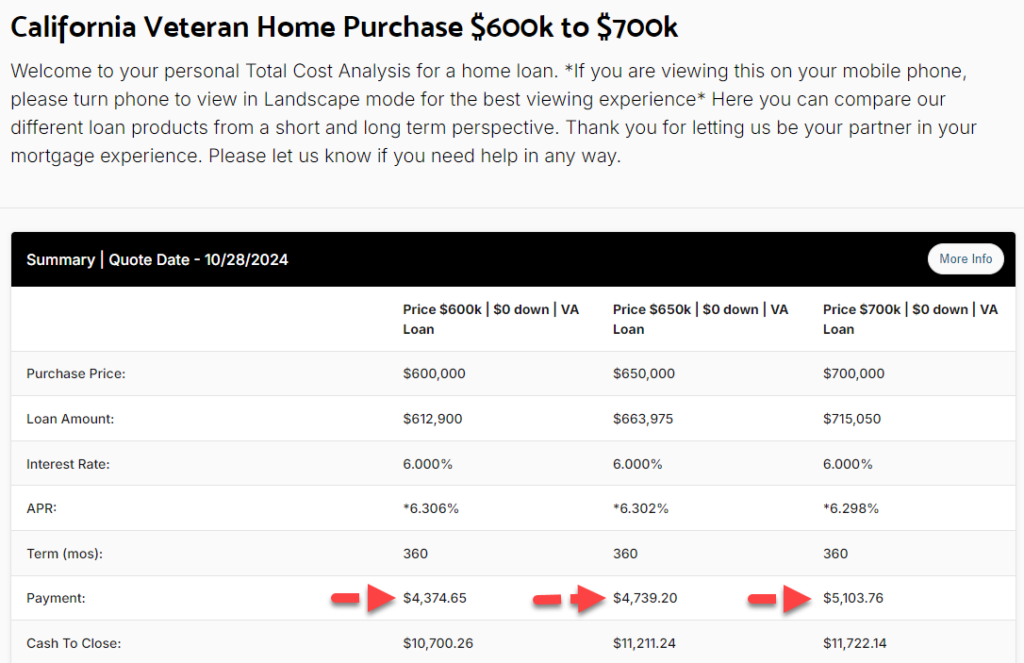

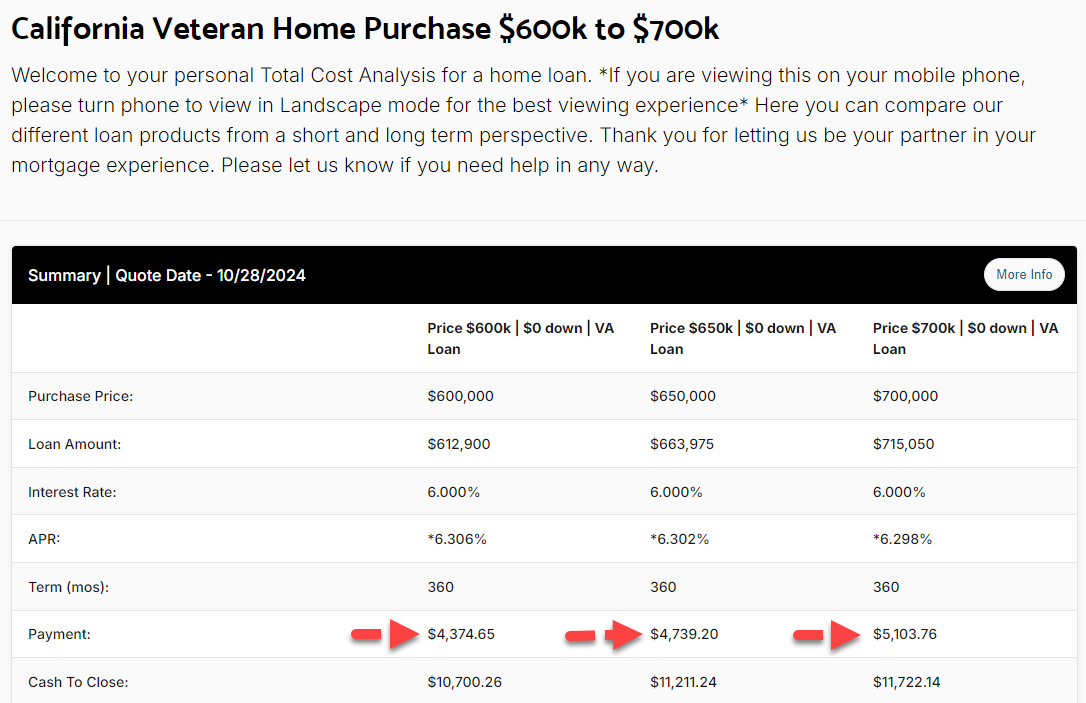

The first step in the home-buying process should always be to contact a Mortgage Advisor. As a prospective home buyer, you will want to know what payment goes with what purchase price before you get too far into the process. It’s fun to scan the internet for homes to buy, but narrowing down the home search to the properties you are either qualified to buy or that have payments that fit your budget is very important. For many, the home price someone qualifies for may differ from the home price and payment they are comfortable with. Working with a California VA Loan Officer will help you connect the dots. You should be provided several loan scenarios with accurate payment options for the price range you are aiming for.

When you see a home listed for $600,000, being able to quickly know the payment range that comes with a home at that price will put you at an advantage over someone who hasn’t spoken to a VA Mortgage Advisor. Let’s look at the numbers for homes priced in the $600,000 to $700,000 range. These scenarios assume a Veteran purchasing a home in California, with a FICO score above 660, using the VA loan program for the first time.

Video Walkthrough of the California VA Purchase Analysis

Below is a video walkthrough of a VA Purchase Analysis. The video will explain the numbers below in more detail and show you how to navigate around the actual California VA Purchase Analysis.

VA Loan Limits

One of the best things about VA loans, besides the 100% financing component, is that there are no limits to the loan amount. While other loan products offered through Fannie Mae, Freddie Mac, FHA, and USDA have maximum loan limits, VA does not have a limit for a Veteran with full entitlement. This means a California Veteran can purchase a $2,000,000 property in Orange or Los Angeles counties with $0 down payment. Or they can purchase a $1,000,000 property in Riverside County even though the Conventional loan limit for 2024 is $766,550.

To have me prepare a custom VA Purchase Analysis, please email, call, or complete the contact form on the website.

Authored by Tim Storm, a California VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Arbor Financial Group NMLS 236669. My direct line is 714-478-3049. I will prepare custom VA loan scenarios that will match up to your financial goals, both long and short-term. I also prepare a Video Explanation of your scenarios so that you can fully understand the numbers BEFORE starting the loan process specializing in VA Loans. MLO 223456