Not many California Veterans realize they can use their VA Entitlement to purchase a home more than once. There is no limit to how many times the VA loan program can be used for a home purchase. While many California Veterans think of the VA loan program as a “First Time Buyer” program, it has many advantages over another type of home financing, even when the California Veteran plans to use a down payment for their home purchase.

Why Use the VA Loan Program?

VA has many advantages over other types of home financing. Below are a few reasons why the VA loan program is the best financing option for most California home purchases by Veterans.

- A down is not required, and there is no loan limit to the purchase price for 100% financing.

- There is no monthly mortgage insurance. Compare this with other loan programs that allow for less than 20% down and you’ll find there is always some form of mortgage insurance, whether it is paid separately or built into the interest rate. With VA, there is no difference in interest rate between a $0 down payment transaction and a 20% down transaction.

- Underwriting flexibility in terms of the “debt to income” ratio. VA does not have a maximum debt-to-income requirement. At the same time, other types of loan programs will not allow the debt to income to be higher than 43% (in the case of many Jumbo programs), 45% to 50% (in the case of typical Conventional programs, depending on down payment), and 57% (in the case of FHA, although FHA cuts the debt to income ratio off at 47% for the “front end” ratio, which is the mortgage payment divided by the income). This just means qualifying for a bigger loan with VA is easier.

- Underwriting flexibility in terms of credit. VA only requires a two-year wait after a bankruptcy or foreclosure. Conventional loan programs require anywhere from 3 to 5 years for a bankruptcy and 5 to 7 years for a foreclosure. Also, VA is far more flexible with FICO scoring. While Conventional interest rates are negatively affected by FICO scores below 740, the adjustments to VA interest rates tend to be minimal (if at all), down to a 660 FICO, and still only slightly down to a 620 FICO. This can vary from one lender to the next. Still, it is worth knowing that if your FICO score is below 680, VA will most likely be a favorable loan program versus Conventional financing, even if there is a significant down payment.

- Straightforward Refinance program -VA Interest Rate Reduction Refinance Loan (IRRRL). While not always considered a reason to use VA, it should be. Interest rates are always fluctuating up and down. The VA IRRRL allows current VA loan borrowers to quickly and easily take advantage of an improvement in interest rates without going back through the qualifying process. Also, no appraisal is required, which helps keep refinance fees to a minimum. VA requires at least 210 days have passed since the first payment due date, and the new interest rate needs to be at least .5% lower than the current interest rate. Also, refinance must result in a “break-even” of the closing costs in 36 months or less. Any California Veteran who has used an alternative program to VA, like FHA, realizes later that if they had used VA financing the first time, the refinance would have been cheaper and easier since the VA IRRRL is only for VA to VA refinances.

- Manual Underwriting allowed for FICO’s down to 500 – While most lenders require an Automated Approval, there are lenders that will do a “manual underwrite”. This helps California Veterans with FICO scores under 580.

All of these advantages help to explain why a California Veteran should always consider using the VA loan program for not only their first home purchase but also any future home purchase, as with any home purchase, which tends to be one of the most significant investments an individual will ever make, a thorough review of the numbers should be made. Understanding not only the short-term costs of the loan but also the long-term costs and how those costs and monthly expenses will fit into your budget is an essential step in the home-buying process.

All of these advantages help to explain why a California Veteran should always consider using the VA loan program for not only their first home purchase but also any future home purchase, as with any home purchase, which tends to be one of the most significant investments an individual will ever make, a thorough review of the numbers should be made. Understanding not only the short-term costs of the loan but also the long-term costs and how those costs and monthly expenses will fit into your budget is an essential step in the home-buying process.

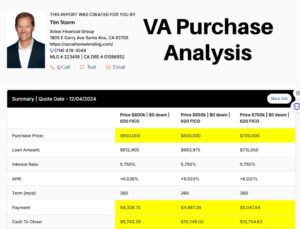

The first and most important step in the homebuying process is to talk to a VA Mortgage Advisor, who will prepare a personalized VA Purchase Analysis.

Authored by Tim Storm, a California VA Loan Officer specializing in VA Loans. MLO 223456. – Please contact my office at Arbor Financial Group NMLS 236669. My direct line is 714-478-3049. I will prepare custom VA loan scenarios that match your financial goals, both long and short-term. I also prepared a video explanation of your scenarios so that you can fully understand the numbers BEFORE starting the loan process, which specializes in VA loans. MLO 223456