Not many California Veterans realize they can use their VA Entitlement to purchase a home more than once. There is no limit to how many times the VA loan program can be used for a home purchase. While many California Veterans think of the VA loan program as a “First Time Buyer” program, it has […]

Category: VA Loan Information

Is an Escrow Account Required on a VA Loan in California?

99.9% of VA lenders require an impound/escrow account for property taxes and insurance to be part of a VA loan. But it’s not something that VA requires. It’s just a lender requirement. Here’s the good news: You can get a VA loan and not have an impound/escrow account. But why is that a good thing […]

How a California Veteran Can Qualify for a VA Loan

The VA Home Loan Program is designed to help California veterans who served honorably, and their surviving spouses, buy homes as they start to lay down roots here in California. The VA loan program does not require a down payment or mortgage insurance and offers interest rates that are usually below market. Best of all, there […]

Destroying 3 Myths about the VA Loan Program in California

There are many myths about the VA loan in California. Here, we discuss three of those myths and tell why they are not true.

VA Approved Condo | What you Need to Know for VA Financing

What is a VA Approved Condo? And why do you need to know what a VA approved condo is? If you are a Veteran planning to purchase a condo using your eligibility for a VA loan, then you need to know what a VA approved condo is and how to distinguish what is VA approved […]

How to get a VA loan in California

How do you get a VA loan? Not every eligible Veteran takes the same path to homeownership, but those that follow a roadmap will have an easier time than those that go about buying a home in willy-nilly fashion. Knowing the steps and following them before you begin looking at homes will help to keep you […]

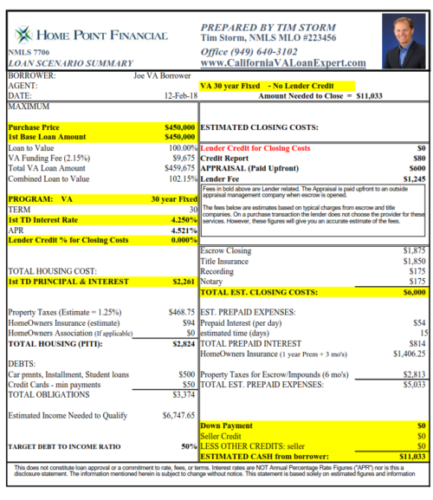

Example of a $450,000 Home Purchase using VA Financing in California

Buying a home in California can be a challenge. The biggest hurdle preventing most potential homebuyers is the down payment. While there are loan programs, like FHA, that allow for down payments as little as 3.5% down, it can still take time to save that much money. Someone buying a home for $450,000 in California […]

Is an Impound Account Required on VA Loans in California?

Is an impound account required with a VA loan in California? That is a fairly common question once we get past the initial question, “What is an Impound Account?” There are only a few loan programs available to borrowers that require little to no down payment for a home loan. Since these borrowers are considered a […]

New California VA Buyers Should be Aware of Supplemental Property Tax Bills

In the first year of home ownership, most home buyers will receive a Supplemental Tax bill. For California Veterans who used VA financing and have their taxes paid from their impound account, receiving a Supplemental Tax bill causes confusion. “Shouldn’t the supplemental tax bill be paid from the impound account?”. In many case, the answer […]

VA Loan Limits in California Increase to $679,650 for 2018

California VA Loan Limits for some high priced counties in California will be $679,650, which is welcome news for those counties where property values continue to rise. The highest Zero Down VA loan limit in California in 2017 was $636,150. An increase of over $40,000 for Zero Down financing is a big jump. What the […]