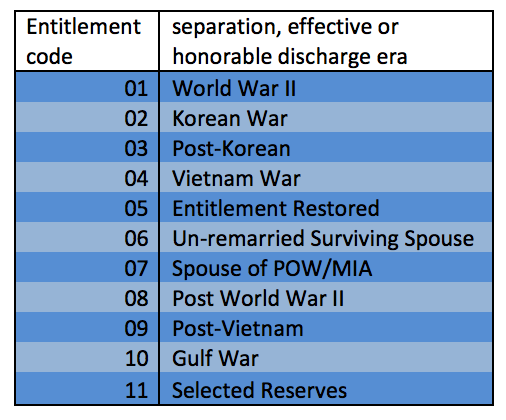

The first step a California Veteran will need to complete in securing a VA loan is to obtain your Certificate of Eligibility. The Certificate of Eligibility, also known as the the COE, is a document that the Veterans Adminstration issues, which verifies your eligibility for VA financing. On the COE there is a number listed […]

Category: VA Loan Information

Why California Veterans Should use the VA Loan Program to Buy a Home

Buying a home can be a difficult proposition for most non-Veteran Californian’s. The biggest hurdle to buying a home in California is the down payment. But this is where California Veterans have a big advantage over non-Veterans, because the VA loan program eliminates the need for a down payment. The VA mortgage is an […]

Getting a VA Loan in California After a Bankruptcy or Foreclosure

Buying a home using VA financing in California after a foreclosure or bankruptcy is possible sooner than many Veterans realize. But it does take some planning in order to make sure the VA loan is approved. Understanding the wait periods that VA requires after a bankruptcy or foreclosure […]

Which is better? VA Home Loan versus CalVet Home Loan

The CalVet home loan and the VA home loan programs are the primary home financing options for California Veterans. CalVet and VA both offer Zero Down Financing, but which program is the best for California Veterans? Well, it depends. There are several factors that play into which program is best for your situation. The type of property and […]

How Bonus Entitlement Helps Veterans Buy Homes in California

One of the most common misconceptions of VA lending guidelines is how a VA Loan can help to buy a home in an expensive state like California. Whether you’re looking to buy near a local ski resort, a beach-side community, or your own slice of heaven somewhere in the middle, the cost of homes is […]

Top 10 VA Loan Benefits for a CA Veterans

When it comes to financing a home in California, the options seem nearly endless. Even homeowners who’ve been through the process many times will tell you that it can be a challenging just trying to choose a lender. And each lender you speak with will have their own recommendations for what’s best for you. Because […]

Why You Should Let a California VA Lender Retrieve Your Certificate of Eligibility

The Certificate of Eligibility (COE) is an important step in starting the VA loan process. This document declares your eligibility for the VA loan program. When looking to start the loan process, you can either get the COE yourself or have your California VA lender request it for you. The fastest and easiest way to […]

4 myths about the VA loan program

The VA loan program is an amazing benefit for our veterans in California. Surprisingly, there are thousands of veterans in California that haven’t used the program because of some longstanding misconceptions about VA loans. Here is the truth behind 4 of the most popular myths regarding the VA loan program… Myth #1: You need to […]

VA Loan Calculator for California Veterans

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] Finding an accurate VA Loan calculator is not an easy task for California Veterans. Researching and doing your due diligence is important when in the process of searching for a VA loan to purchase or refinance a home. Some mortgage websites provide a loan calculator […]

What is Needed to Qualify for a VA Loan in California?

[et_pb_section admin_label=”section”][et_pb_row admin_label=”row”][et_pb_column type=”4_4″][et_pb_text admin_label=”Text” background_layout=”light” text_orientation=”left” use_border_color=”off” border_color=”#ffffff” border_style=”solid”] What is needed to get a VA loan in California? Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. […]