How do you get a VA loan? Not every eligible Veteran takes the same path to homeownership, but those that follow a roadmap will have an easier time than those that go about buying a home in willy-nilly fashion. Knowing the steps and following them before you begin looking at homes will help to keep you […]

5 Financial Reasons for California Veterans to Buy a Home

There are many reasons a California Veteran should by a home. Property values in California have fully recovered in most counties compared to values in 2008 after the “mortgage meltdown”. Mortgage underwriting standards are now much stricter than they were prior to the crash, which has helped to stabilize the real estate market., Homebuyers are […]

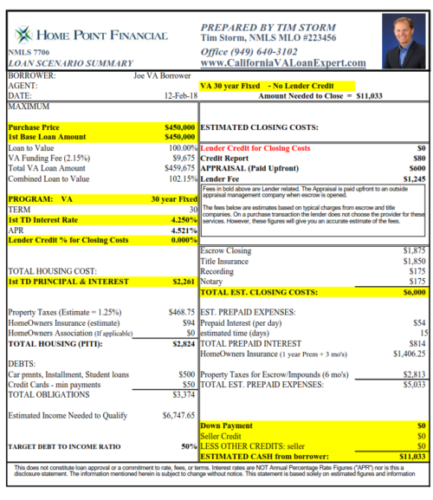

Example of a $450,000 Home Purchase using VA Financing in California

Buying a home in California can be a challenge. The biggest hurdle preventing most potential homebuyers is the down payment. While there are loan programs, like FHA, that allow for down payments as little as 3.5% down, it can still take time to save that much money. Someone buying a home for $450,000 in California […]

Is an Impound Account Required on VA Loans in California?

Is an impound account required with a VA loan in California? That is a fairly common question once we get past the initial question, “What is an Impound Account?” There are only a few loan programs available to borrowers that require little to no down payment for a home loan. Since these borrowers are considered a […]

What is the VA Funding Fee?

A common question from California Veterans when applying for a VA loan is “What is the VA Funding Fee?” The VA mortgage program has many benefits, including no down payment and no monthly mortgage insurance. There is one unique cost however, that is known as the VA Funding fee. The funds from this […]

What is the maximum loan to value on a VA cash out refinance?

The VA mortgage program is an excellent option for California’s Veterans when it comes to refinancing home to pull cash out. Similar to how VA allows for 100% financing on a home purchase, VA also allows 100% financing on cash out refinances. There are two main types of refinance programs available using VA financing. The […]

Do you qualify for a California VA loan right now?

Do you qualify for a California VA loan right now? Do you know what it takes to qualify? California has one of the highest concentrations of Veterans throughout the country but many of them don’t even know that they are eligible for the VA loan program or don’t know what is needed to be qualified. It […]

New California VA Buyers Should be Aware of Supplemental Property Tax Bills

In the first year of home ownership, most home buyers will receive a Supplemental Tax bill. For California Veterans who used VA financing and have their taxes paid from their impound account, receiving a Supplemental Tax bill causes confusion. “Shouldn’t the supplemental tax bill be paid from the impound account?”. In many case, the answer […]

VA Loan Limits in California Increase to $679,650 for 2018

California VA Loan Limits for some high priced counties in California will be $679,650, which is welcome news for those counties where property values continue to rise. The highest Zero Down VA loan limit in California in 2017 was $636,150. An increase of over $40,000 for Zero Down financing is a big jump. What the […]

Have You Been Told You’re Not Eligible for a VA Loan?

Having Zero Entitlement on your Certificate of Eligibility doesn’t mean you can’t buy home with Zero down payment using a VA loan. Earlier this year, an Air Force Veteran and his wife were considering the purchase of a new home. Being experienced homeowners, they began the mortgage pre-qualification process with a local mortgage professional. At […]