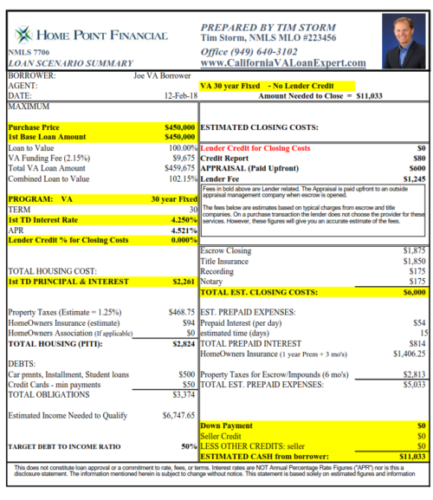

Buying a home in California can be a challenge. The biggest hurdle preventing most potential homebuyers is the down payment. While there are loan programs, like FHA, that allow for down payments as little as 3.5% down, it can still take time to save that much money. Someone buying a home for $450,000 in California […]

Category: Blog

Is an Impound Account Required on VA Loans in California?

Is an impound account required with a VA loan in California? That is a fairly common question once we get past the initial question, “What is an Impound Account?” There are only a few loan programs available to borrowers that require little to no down payment for a home loan. Since these borrowers are considered a […]

What is the VA Funding Fee?

A common question from California Veterans when applying for a VA loan is “What is the VA Funding Fee?” The VA mortgage program has many benefits, including no down payment and no monthly mortgage insurance. There is one unique cost however, that is known as the VA Funding fee. The funds from this […]

What is the maximum loan to value on a VA cash out refinance?

The VA mortgage program is an excellent option for California’s Veterans when it comes to refinancing home to pull cash out. Similar to how VA allows for 100% financing on a home purchase, VA also allows 100% financing on cash out refinances. There are two main types of refinance programs available using VA financing. The […]

Do you qualify for a California VA loan right now?

Do you qualify for a California VA loan right now? Do you know what it takes to qualify? California has one of the highest concentrations of Veterans throughout the country but many of them don’t even know that they are eligible for the VA loan program or don’t know what is needed to be qualified. It […]

New California VA Buyers Should be Aware of Supplemental Property Tax Bills

In the first year of home ownership, most home buyers will receive a Supplemental Tax bill. For California Veterans who used VA financing and have their taxes paid from their impound account, receiving a Supplemental Tax bill causes confusion. “Shouldn’t the supplemental tax bill be paid from the impound account?”. In many case, the answer […]

Have You Been Told You’re Not Eligible for a VA Loan?

Having Zero Entitlement on your Certificate of Eligibility doesn’t mean you can’t buy home with Zero down payment using a VA loan. Earlier this year, an Air Force Veteran and his wife were considering the purchase of a new home. Being experienced homeowners, they began the mortgage pre-qualification process with a local mortgage professional. At […]

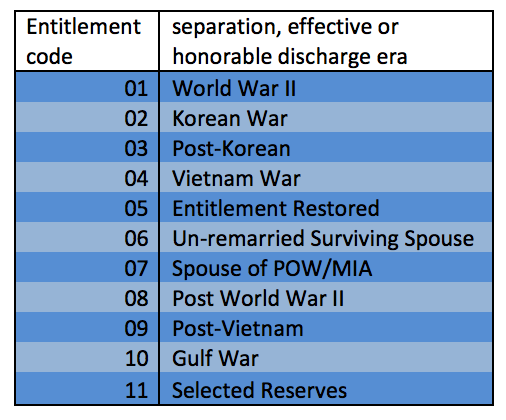

VA Entitlement Codes on the Certificate of Eligibility

The first step a California Veteran will need to complete in securing a VA loan is to obtain your Certificate of Eligibility. The Certificate of Eligibility, also known as the the COE, is a document that the Veterans Adminstration issues, which verifies your eligibility for VA financing. On the COE there is a number listed […]

Why California Veterans Should use the VA Loan Program to Buy a Home

Buying a home can be a difficult proposition for most non-Veteran Californian’s. The biggest hurdle to buying a home in California is the down payment. But this is where California Veterans have a big advantage over non-Veterans, because the VA loan program eliminates the need for a down payment. The VA mortgage is an […]

Getting a VA Loan in California After a Bankruptcy or Foreclosure

Buying a home using VA financing in California after a foreclosure or bankruptcy is possible sooner than many Veterans realize. But it does take some planning in order to make sure the VA loan is approved. Understanding the wait periods that VA requires after a bankruptcy or foreclosure […]